Medical insurance in the United States is mostly private.While the United States is the country where the greatest medical advances are, it is also true that it is one of the few first world countries (perhaps the only one) in which there is no universal medical insurance, which means that this country does notIt guarantees or has free medical insurance (such as Spanish Social Security) for its citizens or for tourists.Only people with very few economic resources, those considered poor, can opt for a government medical service such as Medicare or Medicaid.

Most individuals obtain private medical insurance through their employment, although not even the employer offers medical insurance.On the other hand, American students are accepted by private medical insurance offered by their own university, as they are low (about $ 1000 a year).

The implications of not having a universal medical insurance make universities or other educational entities require foreign students to take advantage of a private medical insurance plan upon arrival in the United States.

The reason is that any medical difficulty can be a great disbursement of money.For example, the cure of a pneumothorax usually costs about $ 50,000 and one night in a hospital, $ 10,000.This makes it necessary to have medical insurance.

As private medical insurance, it is important to keep in mind that not everything is usually covered.Therefore, when hiring private medical insurance, it is important to know several terms to understand its conditions:

- “Copay” or copayment: monetary percentage that the insured must pay for a covered service.For example, medical insurance may cover 80% of each visit to the doctor, therefore, the insured must pay 20% of the cost of the visit.

- “Out of Pocket Money”: Cost of non -covered medical services (exclusions) for medical insurance, the assurance must pay in full for them.

- Pre existing condition: refers to medical conditions of the insured prior to the hiring of private insurance.Many insurance do not cover previous disease treatments.In addition, some medical insurance includes within Pre -existing Conditions to medical treatments or medications that arise within the first 12 months of insurance hiring.

- Limitations and Exclusions: Limitations refers to insurance limitations in terms of covering medical treatments or prescriptions, that is, medical insurance would not cover the total cost of certain treatments or medications.As for exclusions, it refers to medical services or medications that insurance does not cover.

- Dental Insurance: Dental insurance is not usually covered in private medical insurance, so it would be necessary to pay an extra amount to hire it.

- Deducible Money: amount of money that the insured must pay in advance with any medical treatment or urgency.In the case of attending the doctor, the insured pays an invoice and then fills a series of papers to claim the amount paid, the insurance will return to the insured the corresponding part of that invoice.

- Covered Medical Expenses: Medical expenses covered by insurance.

- In Network and out of network provider: Medical centers (consultations and hospitals) that are within the network of suppliers associated with insurance, In Network Provides, have agreed a reduced price for insured.Those outside the network, Out of Network, will charge more expensive.

- Coverage/Prescription BENEFITS Plan: Services or medicines that cover insurance.

- Emergency Services: Emergency services, covered by almost all medical insurance.

- Complements: Complementary medical services that have to be paid apart, such as to be dental or oculista services.

- Dependents or dependents: in private insurance you can add to dependents (husbands or children) in insurance paying a certain amount.

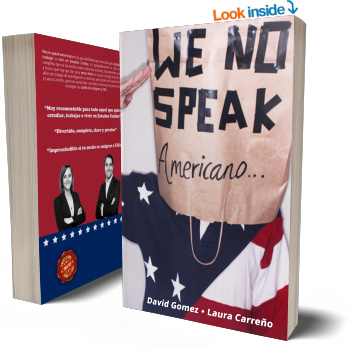

Medical insurance is something relevant to live in the United States and needs to be carefully analyzed.We recommend that you read the capitle that we dedicate to this issue in “We no Speak American.”

🤓 Do you want to know more?

Join our subscription list and Download for free a complete scheme that will guide you in selecting the visa best suited for you.

Leave a comment